Somber Greetings,

This week on still building, my co-writer n00ble and I were about to present a banger project but we’ll have to postpone it a week because at the moment there’s only one thing on everyone’s minds.

The second largest exchange in crypto, FTX, has engaged in what is most likely criminal activity.

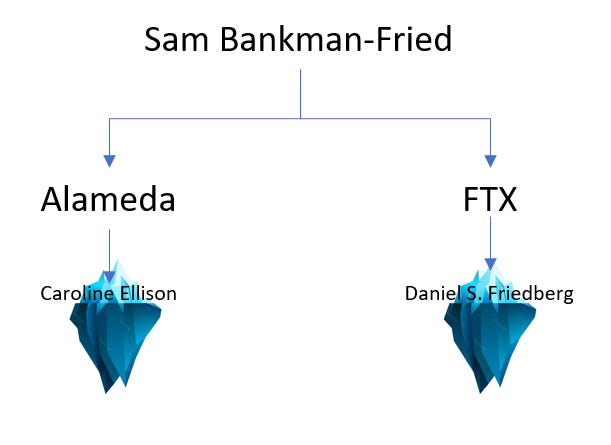

Sam Bankman-Fried, Chief Naughty Officer at FTX, has taken customer funds and used it to fund extremely risky bets for his hedge fund Alameda research and potentially other things we are still finding out about.

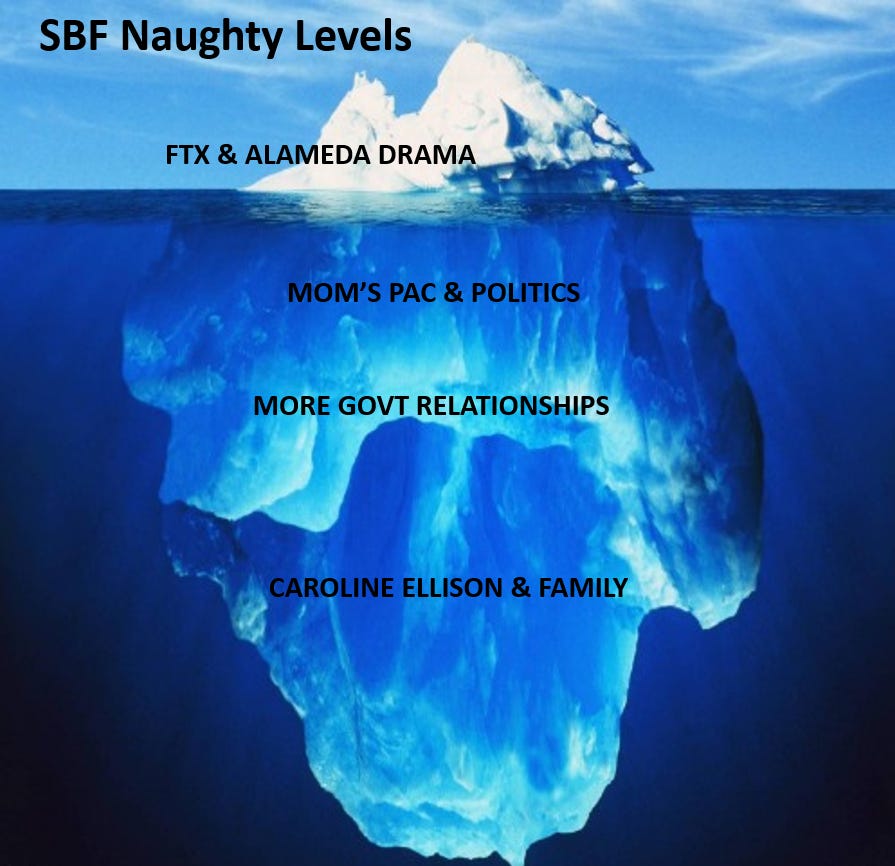

At the moment we’re really only at the tip of the iceberg. The naughtiness goes deep and we’re here to unpack some things that have been bubbling from underneath the surface.

Keep in mind if you’re reading this and are a government agent thinking about assassinating me, I’m only compiling information already publicly available in various media websites and none of this is personally confirmed by me.

We’ll also be talking about how VCs have already considered an event like this a possibility, and how they’ve hedged (and should continue hedging) by investing in companies that would help avoid a situation like this in the future.

On Sam Bankman-Fried’s Iceberg (speedrun)

We’ll go fast and I’ll try to pack in as many details as possible in a concise manner.

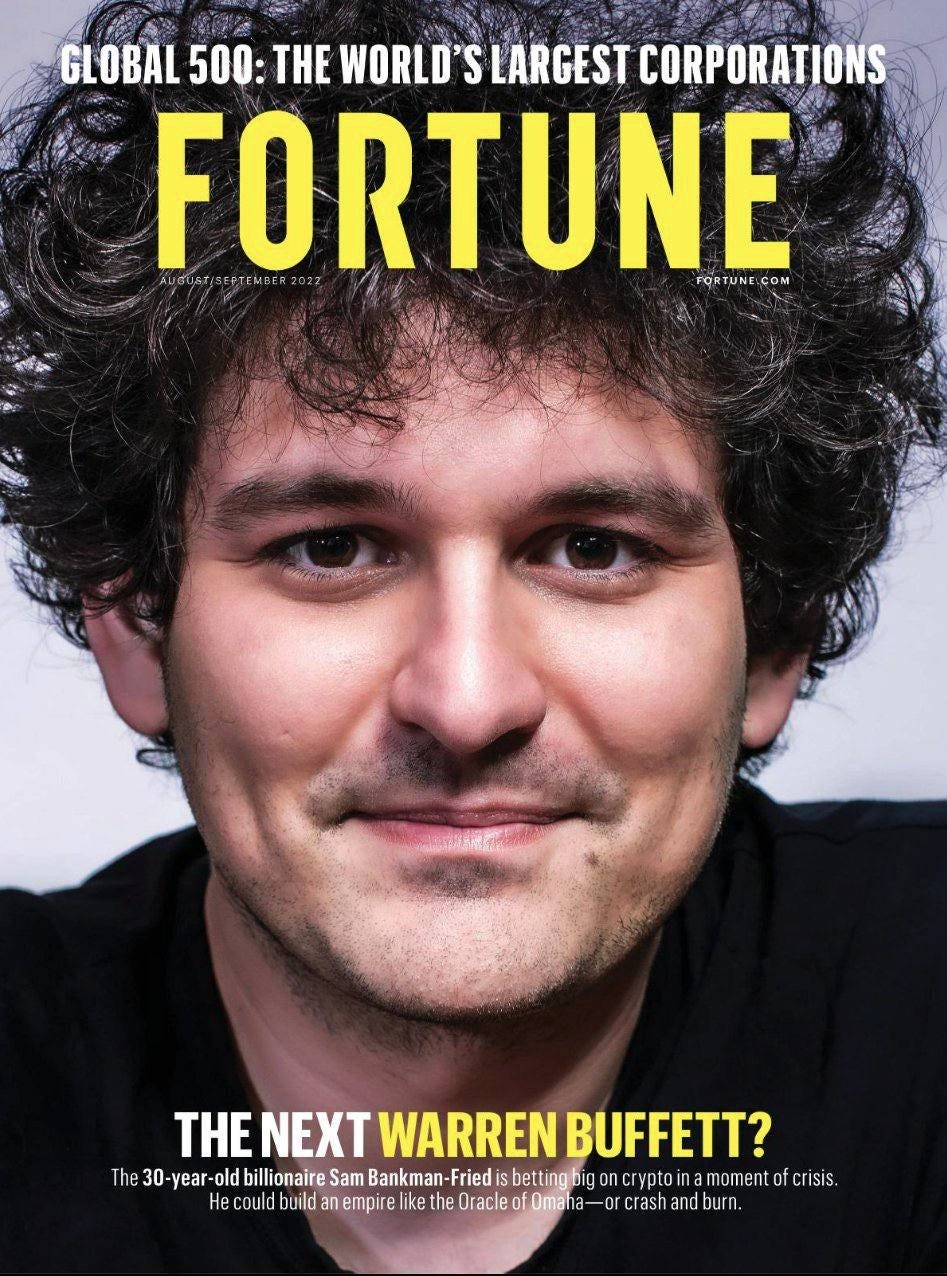

Sam Bankman-Fried, who we will refer to as SBF going forward, is the CEO of now shamed crypto exchange FTX.

With FTX raising at a valuation of $32 billion from a bunch of big name investors earlier this year, SBF was crowned by media and journalists as some boy-genius king who was in line to be the next Warren Buffett.

Fast forward to now, both of SBF’s companies FTX and Alameda have outstanding customer balances estimated between $10-$50 billion.

This was all exposed by a recent orchestrated bank run that they could not fulfill because they did not have the appropriate reserves.

We later find out that the supposed reserves that were meant for customer withdrawals were being used the entire time to fund SBF’s hedge fund Alameda Research’s risky investments.

This is all illegal and stealing customers’ funds while masquerading as an exchange was a shock to everyone.

A Bernie Madoff tier ponzi is now exposed.

As a result, we saw the cryptocurrency market crash and many people are currently dealing with the fallout including resorting to suicide (something that SBF should be personally responsible for, as this is a very serious matter).

But it doesn’t stop there. The internet is undefeated and we’re now unpacking what is beneath the iceberg.

What’s Beneath the Water

Background on SBF

SBF is the son of two Stanford law professors, graduated from MIT in 2014, and after several jobs, founded Alameda Research in 2017. He then launched FTX in Hong Kong in 2019.

Over the past two years he’s gained immense success to the tune of a $32 billion exchange and a $10 billion hedge fund.

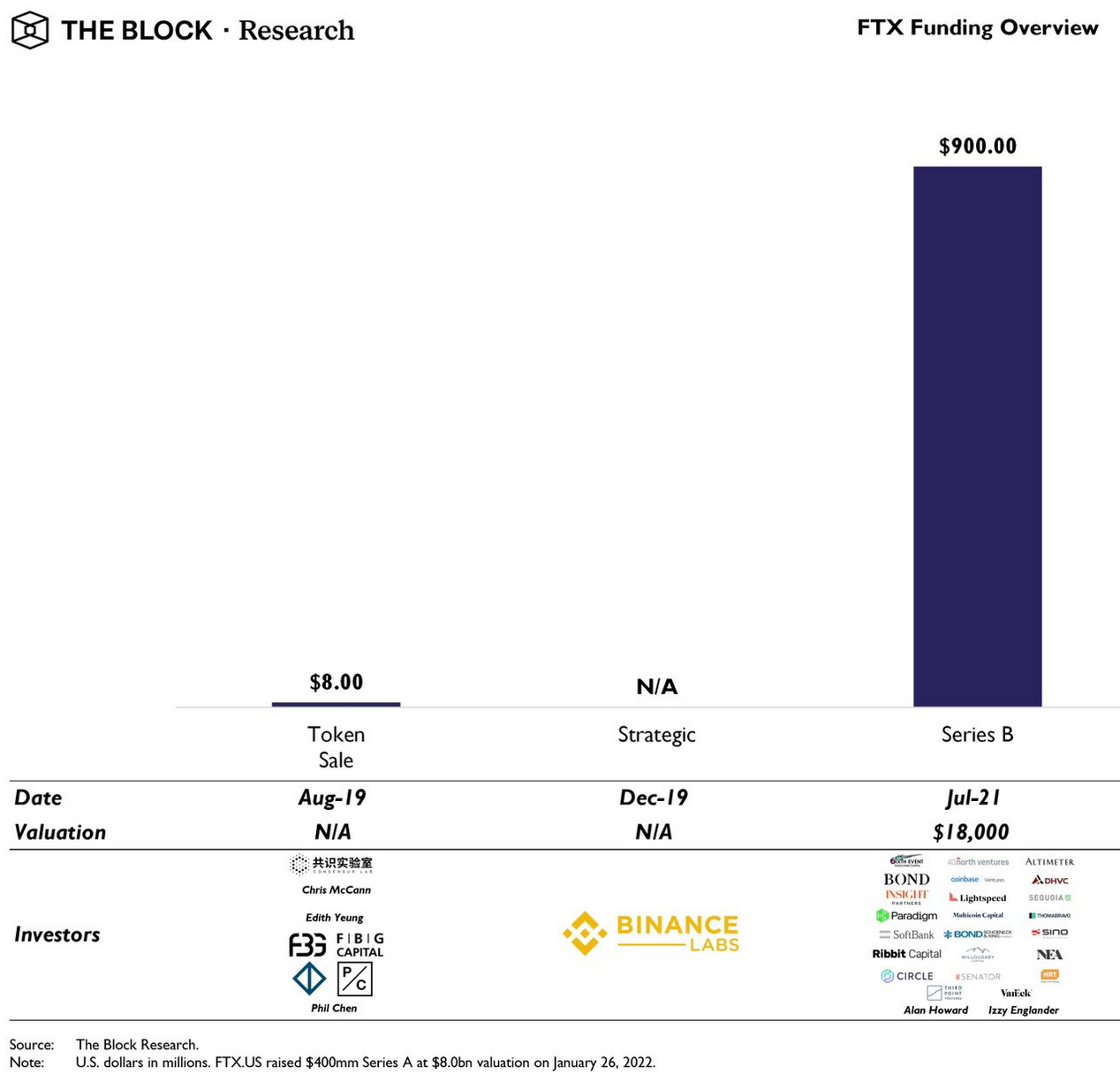

It could be that the exchange he launched was immensely successful and attracted a ton of users, but it launched during a time where there are a ton of other successful competitors and alternatives already exist, so one would wonder, how exactly did FTX skyrocket in value so fast?

As I started doing more reading I came across a few interesting points.

Political Affiliations

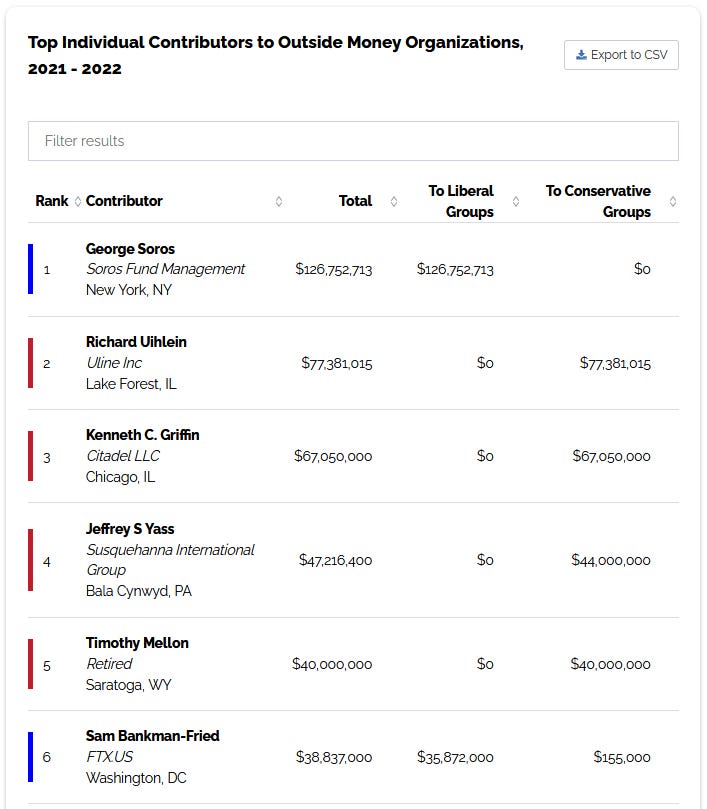

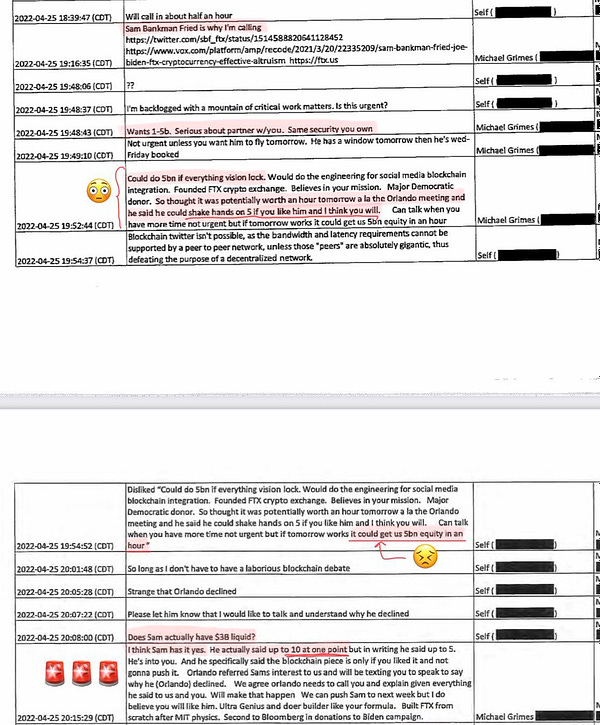

One of the things I find most interesting is that Sam is only 30 years old and he’s a top 6 political donor for the year 2021 - 2022, with most of the money going to Liberal Groups. He is one of the largest donors to the current executive administration of the United States (Biden).

What’s more interesting is that Sam Bankman-Fried’s parents are both heavily involved in politics and have been before his meteoric ascent into success as the crowned king of crypto.

Sam’s mother, Barbara Fried, runs a Democratic PAC named Mind the Gap that earns millions of dollars through donations of Silicon Valley executives and contributes it to Democratic campaigns.

Also, here’s a chart of FTX’s fundraising trajectory with time stamps. It starts with an $8 million token sale with a ton of investors based in Asia and less than 2 years later is able to raise $900 million at an $18 billion valuation with a ton of Silicon Valley Investors.

A speculative timeline would be:

SBF launches exchange with a standard token sale, some but not a lot of money raised to bootstrap operations.

Mom’s Mind the Gap group raises millions for politics and rubs elbows with a ton of Silicon Valley big wigs

SBF is now extremely well connected to Silicon Valley through mommy and can raise insane amounts of money.

Other Government Relationships

In addition to Sam’s mother’s PAC which creates a ton of relationships and funnels money between Silicon Valley and the Democrats, Sam’s father has donated to Elizabeth Warren’s campaigns and has worked with her to build a framework to help simplify paying taxes (honestly a noble cause if it stops there).

This is important to note because Elizabeth Warren has been a staunch advocate against crypto and constantly promoting overbearing regulation when it comes to finance and taxes, such as reporting bank account balances to the IRS.

Naturally, there’s nothing wrong at the surface.

Maybe it’s just nepotism and Mommy and Daddy helped their son meet some wealthy financiers and it just so happens that they also have close ties with the government.

But what we then see is Sam leveraging his access to government officials to try to promote and push legislation that cripples the essence of many parts of crypto, namely decentralization.

The entire crypto community views this as backstabbing the very ecosystem on which he built his wealth.

I personally suspect it is to create a regulatory monopoly where he kills competition.

And More

So, we’ve established the relationship between Sam, family, & government. The other interesting piece in all of this is Alameda Research’s CEO, Caroline Ellison, and the Chief Regulatory Officer for FTX, Daniel Friedberg.

Here’s another iceberg diagram representation to illustrate where we are.

Why is this interesting?

Caroline’s father, Glenn Ellison, is the department head of Economics at MIT, and has a direct relationship with Gary Gensler, the current chair of the SEC.

Maybe this is all coincidental, but it is also possible that a 28 year old trader with poor risk management skills was actively promoted to CEO at a Hedge fund due to access to the top regulatory officials in the US.

Daniel Friedberg, FTX’s Chief Regulatory Officer was a 2008 lawyer who attempted to cover up a 2008 online poker scandal in which the poker company stole customer’s funds.

Sound eerily familiar?

Somehow, 14 years removed from a scandal where his employer steals customers funds, he works for another company where the employer steals funds.

Looks like he didn’t learn from his mistakes the first time around.

So, we’ve done a pretty extensive information dump, there’s a lot to unpack here but let’s highlight key points

FTX as an exchange comes out of nowhere with hyper-growth valuation we’ve never seen prior.

Mom and Dad of Founder and CEO had massive connections with Silicon Valley executives and VCs as well as legislators.

SBF also founded a hedge fund (Alameda) prior to FTX where the sitting CEO has a direct relationship with Gary Gensler through her father.

SBF is the second largest donor to the Democratic party after George Soros in recent years.

SBF actively pushes overbearing legislation on an industry that made him rich.

SBF has been using customer deposits to fund his hedge fund’s bad bets and who knows what else (maybe we know).

The regulatory chief at FTX was previously defending an online poker company that also stole customer funds.

The possible Meta-War

This is where we go into **lore** 😉

As we discuss the fall of SBF, FTX, and over bearing legislative paws on Web3, we must consider the most immediate catalyst. Approximately 5 days ago, Binance’s CEO CZ decides to dump FTX’s underlying token FTT, causing downward price pressure and an ensuing bank run.

This is where we go into interesting speculation (huge emphasis in speculation here).

Twitter was recently acquired by Elon Musk. He’s done a bunch of crazy things and is going to break it until it works. What’s also interesting is CZ is a co-investor of Elon Musk’s acquisition.

Guess who else tried to get in on the acquistion? None other than SBF himself, offering up to $5-$10 billion dollars of money from god knows where.

It is well known that Elon Musk is an increasingly vocal moderate republican with some libertarian ideologies.

He is pro-blockchain and pro-crypto as he has constantly promoted Dogecoin and at one point allowed people to buy a Tesla with Bitcoin. Safe to say that cryptocurrencies are well within his future plans.

He’s also someone who has fought many battles against leftist politicians, the type that SBF donates to. Not only would he not work with SBF, SBF is the exact type of person Elon would despise at an ideological level due to SBF trying to force legislative restriction on crypto itself.

So considering the timing and sequence of events, we’re now looking at something along the lines of this:

Elon along with co-investor & king of crypto CZ complete Twitter acquisition.

Twitter’s Content Moderation staff is fired and political censorship arms are no longer existent.

CZ gets the greenlight to attack the price of FTT causing panic and a bank run on FTX’s reserves.

FTX gets exposed for not having actual reserves. The exchange is now shut down and SBF bankrupt.

Relationship between FTX, SBF, Alameda, and legislators are revealed online and cannot be taken down by political moderation.

*We are now here and will wait to see what happens.*

The Future of Crypto & Web3

So here we are. If you had funds in FTX with the intention of investing or trading, you potentially unknowingly donated to political campaigns you weren’t even aware of.

And the funds are now gone.

This is one of the worst investment scams in history and it might have taken a ton of coordinated effort to fully expose and connect the dots.

There is speculation that SBF is a government agent. Maybe he is or maybe he isn’t. Maybe him and Caroline just knew how to leverage mom and dad’s political connections to commit fraud and donate to government officials in hopes of a get out of jail card if they were caught.

Maybe this was an elaborate plan of crypto-freedom fighters Elon & CZ to expose the system. Or maybe this was just all a coincidence.

The damage has already been done. People are devastated. Some to the point of suicide.

So where do we go from here?

Can we still trust this asset class? Should crypto still be worthy of investment consideration after one of the most catastrophic events of its time?

I think so.

I believe the Silicon Valley investors that were scammed by SBF also still think so as well, given that they invested in alternatives that would render exchanges such as FTX to be non essential in the future.

I also think that many people saw an event like this potentially happening for a while now. The industry is actually more prepared than ever and I’ll try my best to concisely explain why.

Not your keys, not your crypto

This is a very common saying in crypto and this is not the first time users have lost their funds on an exchange. There have been hacks (such as Mt. Gox) and people have lost their money on exchanges multiple times due to parking their funds there.

So while prices, users, and institutions were affected, the reality is that most people did not lose the underlying asset because they’ve already known not to keep money on exchanges.

So why is all this money sitting on or moving through an exchange in the tune of billions of dollars? People typically use exchanges for three reasons:

Move funds in and out of fiat and crypto (Onramps & Offramps)

Place trades

Custody

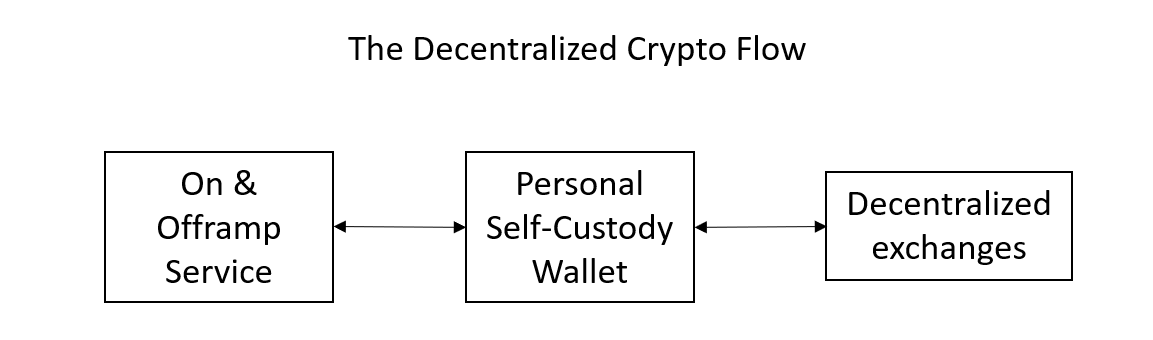

I believe at this point in time, we have technology in place to fully replace exchanges for primary functions for most users so that illegitimate players like FTX can no longer exist off of being a custodian and spending customers deposits without their permission.

How we can replace primary exchange functions

Custody

Custody is relatively easy these days, there are a ton of popular wallets out there that allow you to self-custody.

Examples of these services include: Exodus, Ledger. Metamask, Phantom Wallet

Self custody is a pretty simple solution and while there may be some learning curves for the most novice of users, there are a ton of simplified wallet solutions natively built into applications such as magic.link or sequence.app.

On & Off Ramps

A standalone service that is also built into many wallets are on and off ramp services. These are also fully regulated entities that do not custody funds but accept payments in the form of bank transfers and debit/credit cards in exchange for sending crypto or an NFT to a specific wallet address. Many wallets and applications integrate with these providers so that their users can avoid going through exchanges.

Examples of these services include: Wyre, Moonpay, c14.money, Sardine

Trading

Trading is a core function of exchanges and while it would be difficult to replicate every tiny function of a traditional centralized exchange in a trustless manner, decentralized exchanges exist and are widely used. In addition to decentralized exchanges, there are also easy to use swap protocols, many currently natively built into wallets and can provide cross chain functionality.

Decentralized exchanges and swap protocols are also completely operated on smart contracts and everyone has visibility to how it works.

Examples of these services include: Uniswap, Anyswap, Pancakeswap, Trader Joe

Despite a catastrophic market breaking event in the form of a high profile political donor stealing customer’s funds, there are a lot of tools in place to mitigate future risks and allow every user to invest, exchange, and own their own funds and data.

These tools are also heavily invested in by the same VCs that poured hundreds of millions into FTX (Sequoia, Binance, Lightspeed, Tiger, etc.), potentially as a hedge, but more likely because they saw it as a very real possibility that bad actors exist and ongoing decentralization and separation of powers is needed.

The financial system will continue to be disrupted for the better and I continue to be optimistic and excited about the technology despite the price fluctuations.

-Bry

If you liked this issue, consider subscribing to receive more newsletters from us!

Have a project you’d like us to review? Let us know at stillsubstack@gmail.com!